Weekly Meter

DC / MD / VA / WV

We compare contract activity for the same seven-day period of the previous year in Loudoun County, Prince William County, Northern Virginia, Washington, DC, and Prince George's County. These statistics are updated on a weekly basis. Sign up for our newsletter on the latest market data.

Rates Fall, Activity Rises

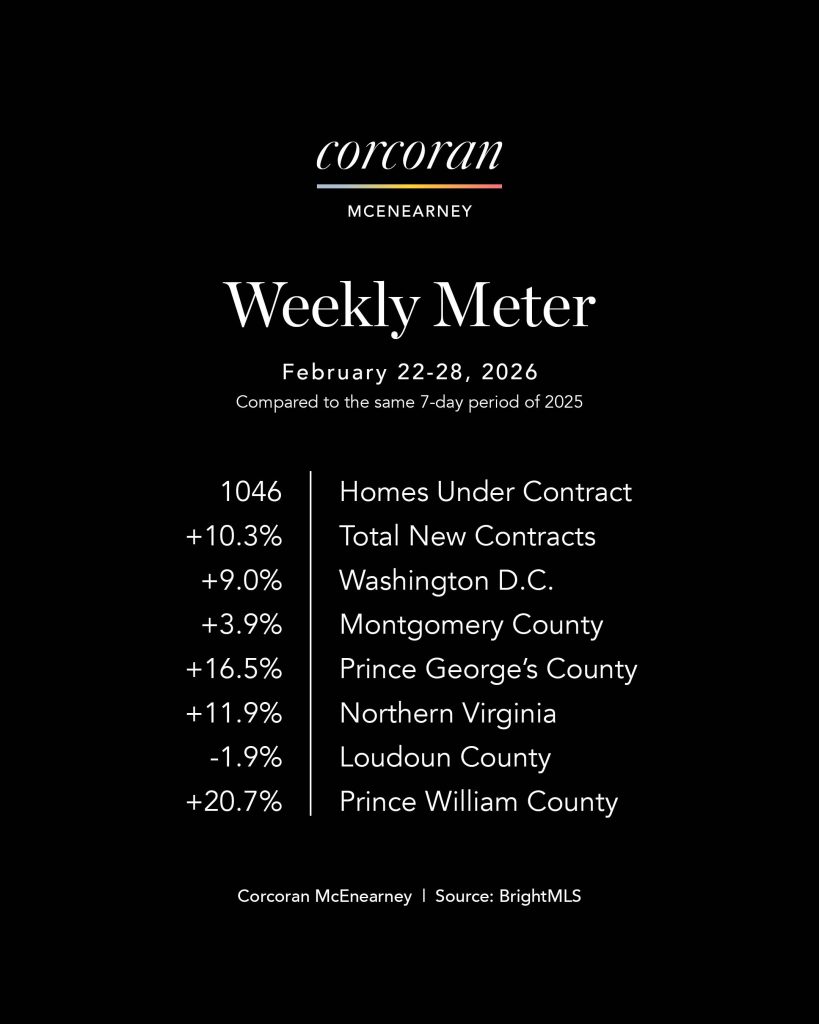

The Metro DC housing market delivered an encouraging signal last week. Total new contract activity rose 10.3% compared to the same week last year.

Key Takeaways

- More than 1,000 newly ratified contracts were recorded for the first time in nearly four months.

- Five of the six jurisdictions we track posted increases in contract activity.

- Loudoun County was the only area with a modest decline, driven largely by constrained inventory. It remains the only jurisdiction with fewer active listings today than at this time last year.

- Through the first two months of the year, total new contract activity is now up 1.9%, led primarily by strength in Northern Virginia and Prince William County

- Despite the rebound in contracts, average days on market increased from 32 days last year to 43 days last week

Why It Matters

- The combination of falling mortgage rates and improved buyer confidence appears to be translating into action. Crossing the 1,000-contract threshold is psychologically meaningful and suggests demand has depth.

- At the same time, the rise in days on market reinforces the broader market shift we’ve been observing for months. Buyers are active, but they are deliberate. Inventory growth in most jurisdictions is giving them options and leverage.

- This is not a return to urgency. It is a return to engagement.

- Loudoun’s modest decline underscores an important point: markets cannot transact without supply. It remains uniquely inventory-constrained compared to the rest of the region.

Lower Rates, Mixed Results - But Momentum Holds

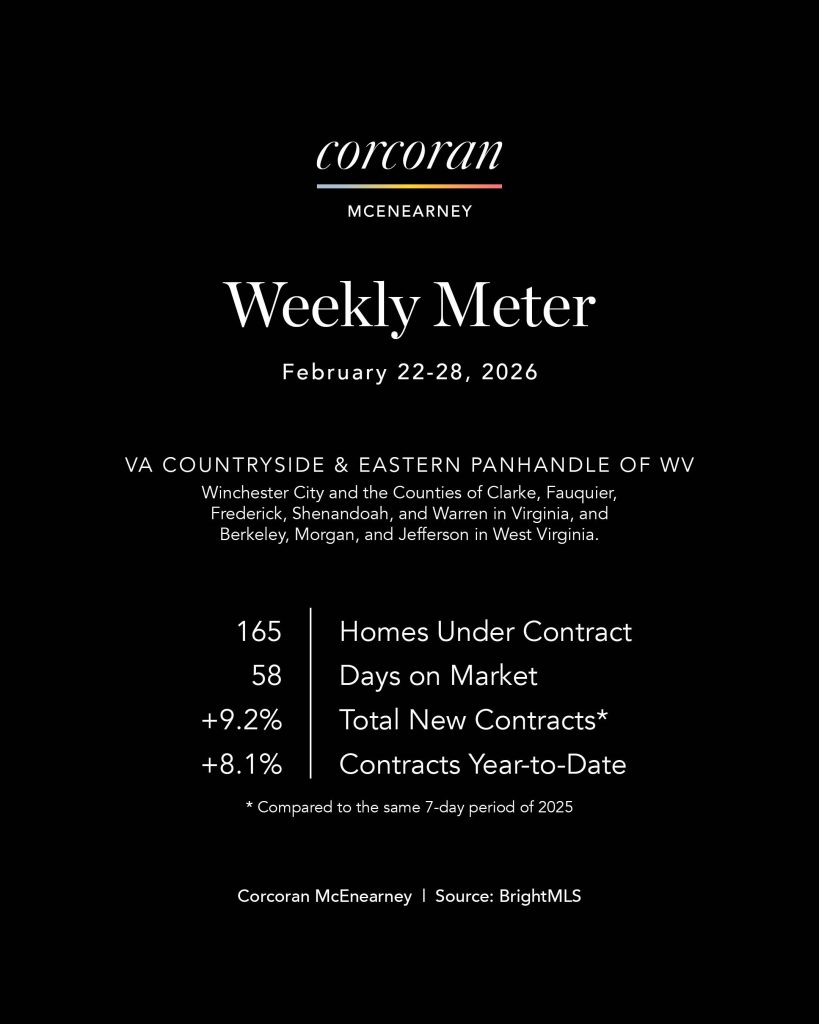

As mortgage rates dipped to their lowest level in three years — now just under 6% — buyers across the Virginia Countryside and West Virginia Panhandle responded. Total new contract activity rose 9.2% compared to the same week last year.

Key Takeaways

- Total contract activity increased 9.2% year over year.

The Virginia Countryside drove the gain with a strong 32.2% weekly increase. - West Virginia experienced a slight pullback, though year-to-date activity remains positive.

- Mortgage rates falling below 6% likely contributed to renewed buyer engagement.

- Days on market continue to climb, rising from 38 days last year to 57 days last week

Why It Matters

- Lower borrowing costs are clearly stimulating demand, particularly in the Virginia Countryside where affordability and lifestyle appeal intersect. A 32% surge in contracts is not a small move — it reflects confidence and responsiveness to rate changes.

- At the same time, the rise in days on market mirrors what we are seeing in the metro area. Buyers are active, but they are no longer operating with urgency. Increased inventory and greater choice are extending timelines.

- This is a healthier pattern than the rapid-fire pace of recent years. Momentum is building, but it is measured.

The Real Estate Details

- Virginia Countryside was up 32.2% for the week and 17.9% year-to-date.·

- West Virginia Panhandle was down 5.2% for the week, but up 9.8% year-to-date